Keyframe is an NYC-based cross-asset investment firm, investing across a diverse range of business models and capital structures. It is a specialized energy transition fund investing somewhere between an early-stage venture and PE/ infra.

Stage: Series A through E + Convertible notes, Asset-backed facilities, Project facilities, PropCo – OpCo structures, and more

Focus Area: Mobility, Transportation and Energy

Investor type: Venture Capital Firm / Cross-asset investment firm

Global HQ: 55th and Park in NYC

Offices: New York

Website: www.keyframecapital.com | Linkedin

Fund Size

- Fund I – ~$156 million (2020)

- Fund II – Undisclosed

Asset under management – ~$1.3 billion with portfolio of 30+ investments

Thesis

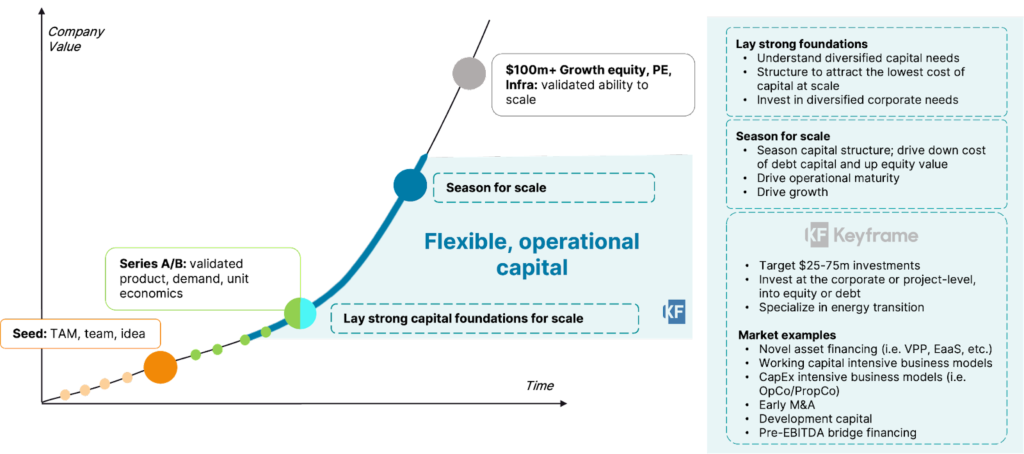

Investment thesis: Focusing on Energy transition and ensuring that firms can avail of required capital

Source: Keyframe Capital

Focus Area: Mobility, Transportation and Energy

Funding stages: Equity (Series A to E), Convertible notes, Asset-backed facilities, Project facilities, PropCo – OpCo structures, and more

Cheque size: $25 million to $75 million

Target countries: All over the world

Portfolio

Current Investments:

|

|

|

|

|

|

|

|

|

|

|

Successful Exit:

General Partners

|

Ben Birnbaum Partner Pennsylvania State University (BSc & MSc – Accounting) |

|

John Rapaport Chief Investment Officer Harvard University (B.A. degree, Magna Cum Laude) |

|

Ethan Goldsmith Partner University of Michigan (Bachelor of Business Administration) |

Successful Exit:

Investment Criteria

The firm focused on the disruption caused by the energy transition – target $25 – 75 million in investments, a sweet spot between VC and PE firms.

Submit Deck

Submit deck online