Beyond the Hype: Navigating the Evolving Landscape of Micromobility

Mobility sector is going through a major transformation in the last decade. Uber has been one of the most innovative startups of this century, creating a new category of “On-demand” and “Shared Economy”. One of the remarkable outcomes of this innovation has been the emergence of micromobility. In September 2017, Bird launched the dockless e-scooters (or popularly called Micromobility) in Santa Monica and since then the company has expanded to more than 350 cities around the world (Bird 2023).

Micromobility can be defined as sub 500 kg, electric vehicles focused on urban transport. In other words, micromobility refers to the transportation of people and goods using lightweight, small-scale vehicles, typically designed for short-distance travel within urban areas. These vehicles are usually electric-powered and offer a convenient and sustainable alternative to traditional modes of transportation like cars or buses for short trips.

The saying goes, “History repeats itself,” and in the case of scooters, this rings true. The Autoped Company is considered the true predecessor of modern scooters. Back in the day, these scooters were incredibly popular, gaining traction not only among the general public but also catching the attention of early adopters like the U.S. Post Office and the New York City Police. The company’s success wasn’t confined to the United States alone; they expanded their operations to England, Germany, and Czechoslovakia, further solidifying the widespread appeal of scooters in different parts of the world.

The micromobility sector is currently undergoing rapid evolution, with various types of micromobility vehicles becoming increasingly popular. The deep dive will focus only on e-scooters segment and may also briefly cover e-bikes segment. However, it’s important to note that we won’t be delving into bike-sharing systems in this deep dive.

The e-scooter industry has experienced significant advancements, with many companies introducing fourth-generation or later models. These newer scooters come equipped with several advanced features such as GPS tracking, smart ADAS (Advanced Riders Assistance Systems), larger wheels, and improved designs to enhance safety and convenience.

These upgrades have had a positive impact on the durability of the scooters, increasing their lifespan from a mere two years to an impressive five years. Moreover, e-scooters offer a cleaner alternative to private cars, contributing to a reduction of 70% to 80% in emissions, making them a more environmentally friendly option for short-distance transportation.

💲 VC Funding

Micromobility sector was the darling of venture capitalists. Bird was founded in September 2017 and within 10 months, the company became the fastest company to reach the $1 billion Unicorn valuation and attracted some of the marque investors including Sequoia Capital, Index Ventures, Valor Equity Partners, and Craft Ventures.

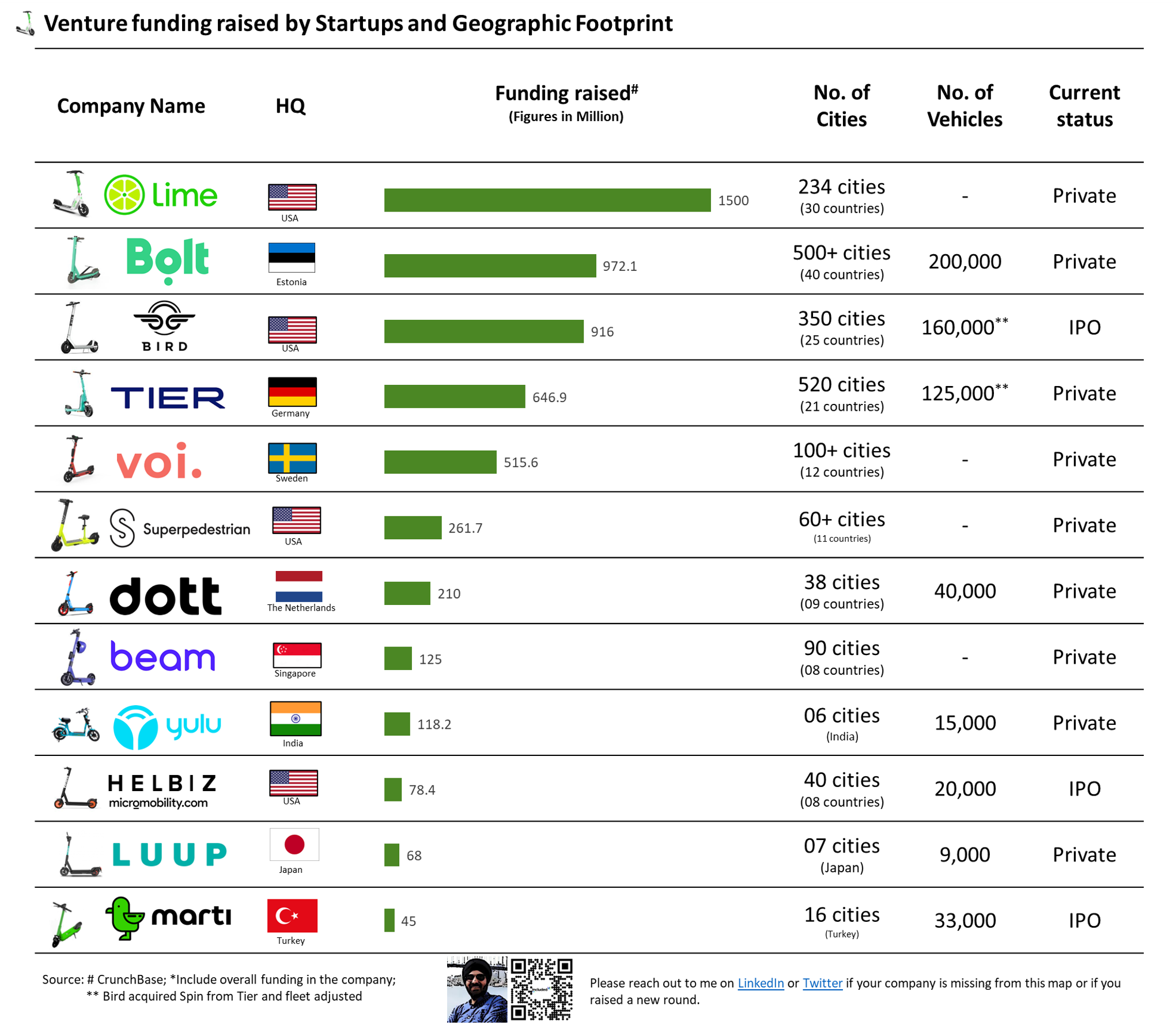

Overall, VC firms and private investor has invested more than $8.4 billion in micromobility (including e-scooters, bicycle, and moped) space till 2022. This immense financial backing showcases the high level of interest and confidence in the growth potential of the micromobility market.

E-scooters attracted a major chuck of investment of $5.2 billion in this period.

Lime has raised the highest amount of funding in the sector, mainly from Uber and Google. However, the market is dominated more by European players.

Bolt recently raised $709 million to expand both ride-hailing and micromobility services in January 2022. It is difficult to value Bolt’s scooter business.

Beam closed $93 million in Series B round in February 2022 to expand its operation in Asia pacific region, including Australia and New Zealand.

There has been no big funding round in 2023 as the focus is shifting to unit economics and profitability.

Only three players (Bird , Helbiz, and Marti Technologies) managed to be listed on the stock exchange through a SPAC (Special purpose acquisition companies) deal. Many other players are planning to list on the exchange in the coming years. However, both companies are struggling as:

Bird Global ($BRDS) stock price is down by 99.91% from the listing price and the current valuation is $7.2 million on 02 October 2023. The company was listed at a $2.3 billion valuation at its peak valuation. Bird Global has been suspended from trading from the NYSE and is now listed on OTC Exchange.

MicroMobility (earlier Helbiz) ($MCOM) is down by 99.90% from the listing price and its current valuation is $11 million on 02 October 2023. The company was valued at $408 million valuation.

Marti Technologies ($MRT) was listed on the stock exchange on 11 July 2023 via the SPAC merger at an initial enterprise value of $532 million. The stock has already nosedived by 93.70% (current market cap of $34.5 million on 02 October 2023)

Some of the companies wind up the operation even after raising mega rounds including Grin ($150 million) etc. There were a number of merger and acquisition deals that happened including Bird acquired Circ (2021) to enter into the European market and Tier acquired Spin (2022) to expand its services in the US. However, Tier sold Spin (2023) to Bird to focus back on the European Market.

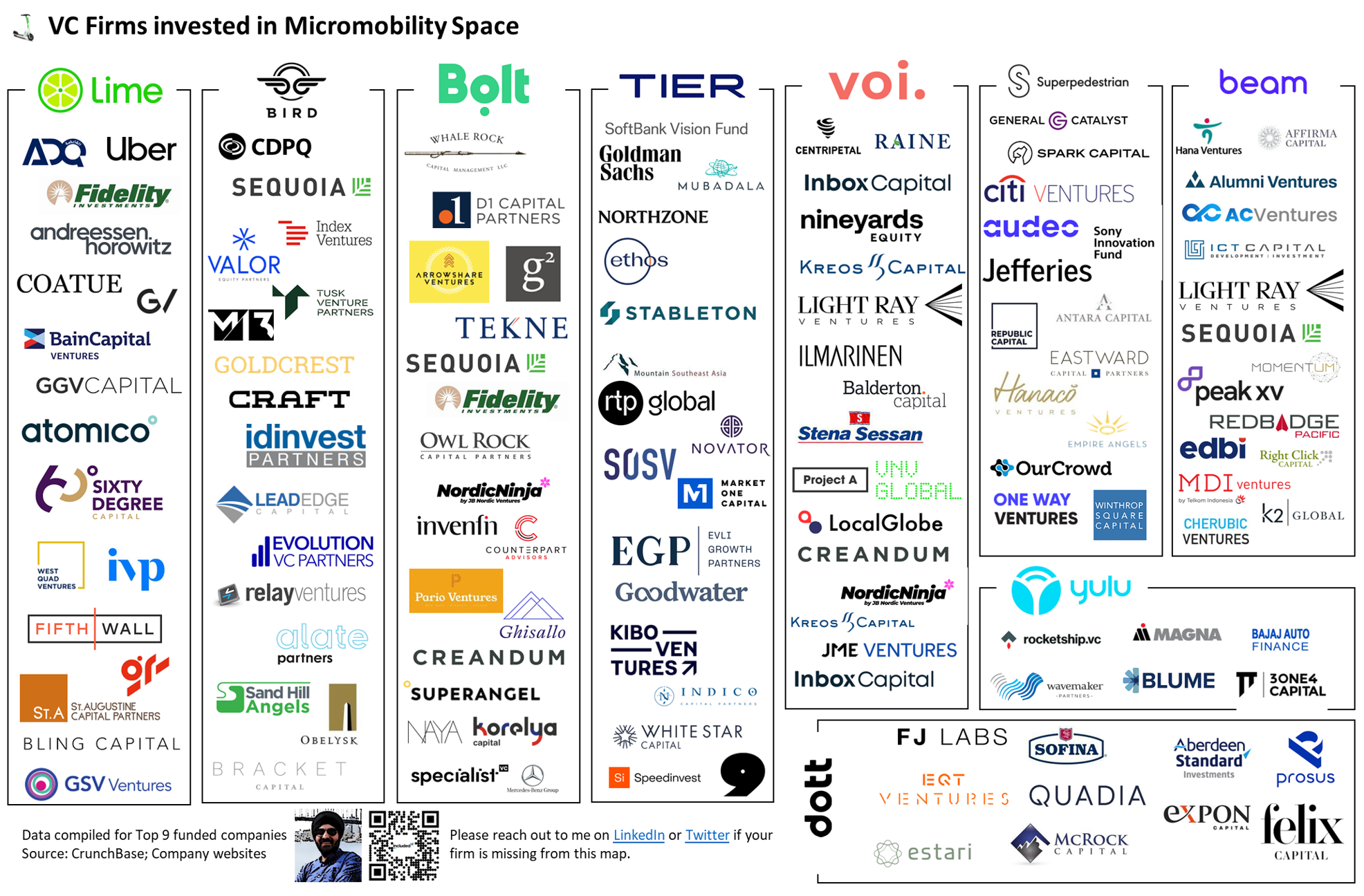

Many VC firms have invested in the micromobility space. Sequoia Capital invested in Bird (USA), Bolt (Europe), and Beam (Asia) to spread investment across different geographies. Further, some firms invested in multiple firms in the same geographies to hedge the risk. The list of different VC firms is given below:

🛴 Is Micromobility dead? Long Live Micromobility

According to BCG analysis, e-scooter markets still have the potential to reach $40-$50 billion market by 2025. However, the calculation was done based on the number of potential users based in different regions. The market is still optimistic about the growth of the micromobility sector.

“Regardless of what value pool you’re in, regardless of what mode you’re in, this is a great story, in our mind, because micromobility is going to grow across the globe. It’s going to grow across form factors, across sharing and ownership” ~ Kersten Heineke, a partner at McKinsey and Company and co-leader of the McKinsey Center for Future Mobility (January 2023)

Micromobility is going through a tough phase after the early year of excitement. As per the Gartner Hype cycle, the Micromobility industry has already moved from a peak of inflated expectations (2019) to a Through of disillusionment (2020). Generally, this phase continues for 2 to 5 years. Thus, the sector is not completely out of the wood and there will be more pain before the gain.

Many key players did mass layoff — Bird (23% workforce), Tier (16%), Lime (13%), and Voi (10%). As the industry is facing further headwinds, Bolt is in discussion to acquire Tier to expand its operation in the US. This will further consolidate the market and it will be challenging for players to compete on a single product portfolio. Bolt is emerging as an alternative to Uber in Europe.

🌀 Evolving landscape of Micromobility

As mentioned above things will get worse before getting better. Micromobility / e-scooters are an important component of the mobility ecosystem. According to NABSA, there are 232,000 vehicles (including e-scooters and e-bikes) in 298 cities in North America. Similarly, there are around 600,000 shared free-floating vehicles (including e-scooters, e-bikes, mopeds etc.) in more than 600 cities in Europe (EIT 2023).

As most of the companies are still private, the data shared by listed companies can be a good indication of market trends:

The adoption of e-scooters continues to grow as Bird completed 47 million trips in 2022 (compared to 39 million in 2021). However, the utilization of vehicles still remains low as the average Rides per Deployed Vehicle per Day was just 1.3 (Compared to 1.6 in 2021 and the industry benchmark of 1.9x in 2021).

Helbiz registered a slowdown as the number of trips from 4.5 million in 2021 to 3.8 million in 2022 as the company closed down operations in many cities and started focusing on licensed operations.

Matri Technologies is performing better compared to other peers with the average Rides per Deployed Vehicles per Day was 2.36 in 2022 (compared to 2.88 in 2021). The company has projected a 12 percent revenue growth in 2023. The company also managed most of its functions in-house, which helped to improve gross margin (40% of the revenue).

The other two players — Lime and Bolt are not listed on a public exchange but are in the process of filing IPOs in 2024 and 2025 respectively. Both companies shared some financial numbers for the year 2022.

Lime completed 120 million trips in 2022 and generated a gross booking of $466 million, an increase of 33% from 2021. The company did not disclose the data on the number of vehicles available on the road. Lime reported an Adjusted EBITDA of $15 million for the year 2022, the first micromobility company to reach profitability.

Bolt reported its revenue numbers for 2022 at the group level (ride-hailing and e-scooter car rental services, and food delivery app). The company reported a total turnover of $1.39 billion (€1.26 billion) and a loss of $80 million (€72 million) for 2022. The company is planning to become profitable before going public in 2025.

Micromobility industry is passing through this shift as startups are trying different ideas to achieve profitability. These tactics include selling vehicles, offering subscriptions, shifting to regulated markets, providing market intelligence, and exploring vertical integration.

To promote better regulation and industry standards, micromobility players are coming together. For instance, organizations like “Micromobility for Europe” and key players such as Bird, Lime, Spin, and Superpedestrian are collaborating to share best practices for regulating e-scooters and e-bikes in North American cities. Some of the key recommendations they propose include:

- Appropriate number of operators to avoid oversaturation of a market

- Long-term programs and contracts

- Uniform and automated data sharing through MDS and GBFS protocols

- Helmets should be encouraged but not mandatory

Private ownership of e-scooters and e-bikes is also gaining traction and becoming competition for the industry. Many cities are offering rebates to users to purchase the vehicles. Denver’s e-bike rebate program allows residents to save up to $1,200 on an e-bike purchase. There are many other cities in North America and Europe that are offering similar programs. Currently, these program does not support e-scooters.

Overall, the industry is undergoing significant transformation as several key trends reshape its landscape and redefine how micromobility services are provided. What are those key trends:

💼 The changing business model — B2C to B2G

Micromobility launched in cities around the world more as B2C (Business to Customers) offering. Companies flooded the sidewalks and streets with dockless electric scooters, following the same playbook of the sharing economy. However, this business model faced challenges as the unit costs were high, and there was a significant issue with theft and vandalism of the scooters.

As the industry matured, many city authorities learned from their previous experience with the ride-hailing sector. They became better prepared and took a more proactive approach. Instead of allowing unregulated proliferation, city authorities started issuing licenses or permits to e-scooter companies and implemented specific regulations. This move helped in managing the micromobility services more effectively and addressing concerns related to safety, parking, and proper usage.

Further, tenders are becoming the norm to regulate the use of micromobility in the city. This helps to reduce the competition in the market and improve vehicle utilization. Currently, the cost of sharing (processing fees, insurance, infrastructure, charging, license fees, depreciation etc.) is around 70–80% of the total revenue (based on Bird data).

“The scooter market has shifted in its short lifespan from a B2C to, in a lot of ways, more like a B2G [business-to-government]. The trend has been for cities to reduce the number of concessions they grant to scooter operators, which puts more pressure on scooter operators to get one of those declining numbers of contracts available. You can’t really overstate how important it is, which technologies will rise and fall, and how companies position themselves.” ~ David Zipper, visiting fellow at the Taubman Center for State and Local Government at the Harvard Kennedy Center

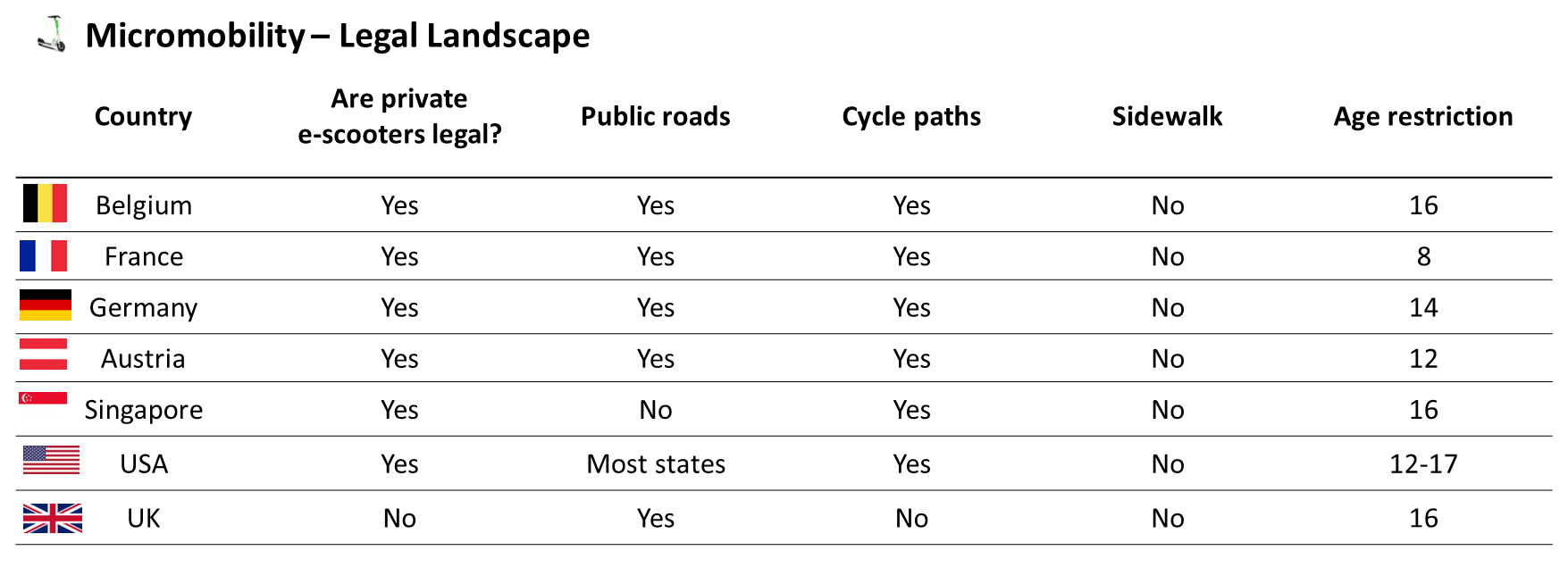

In June 2021, TfL (Transport for London) and London Councils launched a pilot for e-scooters in the city over the next 12 months. The same is now extended for another 2 years till May 2024. The contract was awarded to 3 firms (Dott, Lime, and Tier) to operate 4425 e-scooters with more than 500 designated locations. The players can set their own rental pricing. However, this will give exclusive access to these players.

However, the market environment remained hostile. Recently, Paris voted to ban rental e-scooters in May 2023. Currently, the city has more than 15,000 e-scooters operated by 03 players (Dott, Tier, and Lime), which were removed in the first week of September 2023.

💳 Subscription-Based Micromobility Services

In order to improve the unit cost, the companies are exploring different models including monthly subscriptions for shared e-scooters or monthly subscriptions for leased vehicles.

Lime launched “Lime Prime” offering unlimited rides to users without paying an unlock fee of $5.99 per month. However, the offer was offered to only 27,000 first signups. Owing to low unit cost, the subscription plan for shared services is not very popular.

Similarly, Helbiz offers “Helbiz Plus” at a $51 (€ 45.99) per month plan, a fixed price monthly subscription that allows the riders to take 50 free 30-minute rides every day, all month. It is a global plan and can be used in any city. The company did not share any details on subscribed users. The company generated 15% of its revenue from the mobility subscription business.

“Subscription services for a single vehicle are far more interesting and scalable than the subscription model that was trialed by the shared mobility services. The cost per kilometer is just an order of magnitude smaller, and it’s not constrained by citywide caps.” ~Oliver Bruce, angel investor and co-host of the Micromobility Podcast (July 2021)

However, many new startups launched the HaaS (Hardware as a Service) program to offer e-scooters / e-bikes on monthly subscriptions. As private ownership of micromobility is increasing, subscription plans are emerging as great options. The users can hire vehicles for short (3 months) to long term (12 months), offering more flexibility to the riders.

However, it is challenging to offer both “Pay per use” and “subscription” models as the business model, go-to-market strategy and service requirements for these models are different.

🚉 Integration with Public Transportation

Public Transport is always the backbone of the cities and offers mobility to large masses in the city. Shared micromobility services, similar to ride-hailing services, were seen as competition to public transport. However, there are some partnerships emerged in cities among public transport operators and micromobility players. As per Mobility Innovators analysis, micromobility services works better in cities which have better public transport network (like Berlin) or small cities with better cycling infrastructure (like Tel Aviv)

In late 2020, Voi, S-Bahn Stuttgart, and Mobimeo executed a joint pilot project to showcase the synergies with public transport. The pilot showed that public transport ridership increased by 35% at the pilot station.

Tier is working with 50+ public transport operators in Europe, allowing it to integrate its booking and payment facilities with the partner. This partnership allows micromobility players to access the parking infrastructure at the station and seamless multimodal transportation experiences for riders.

However, TfL recently shared data that revealed that 2.5 million trips were taken by rental e-scooters between June 2021 and November 2022, out of which 93.5 percent of trips would have otherwise been taken by walking, cycling, or public transport.

Partnership with public transport operators will be critical for the success of micromobility services and play an important role in improving unit metrics.

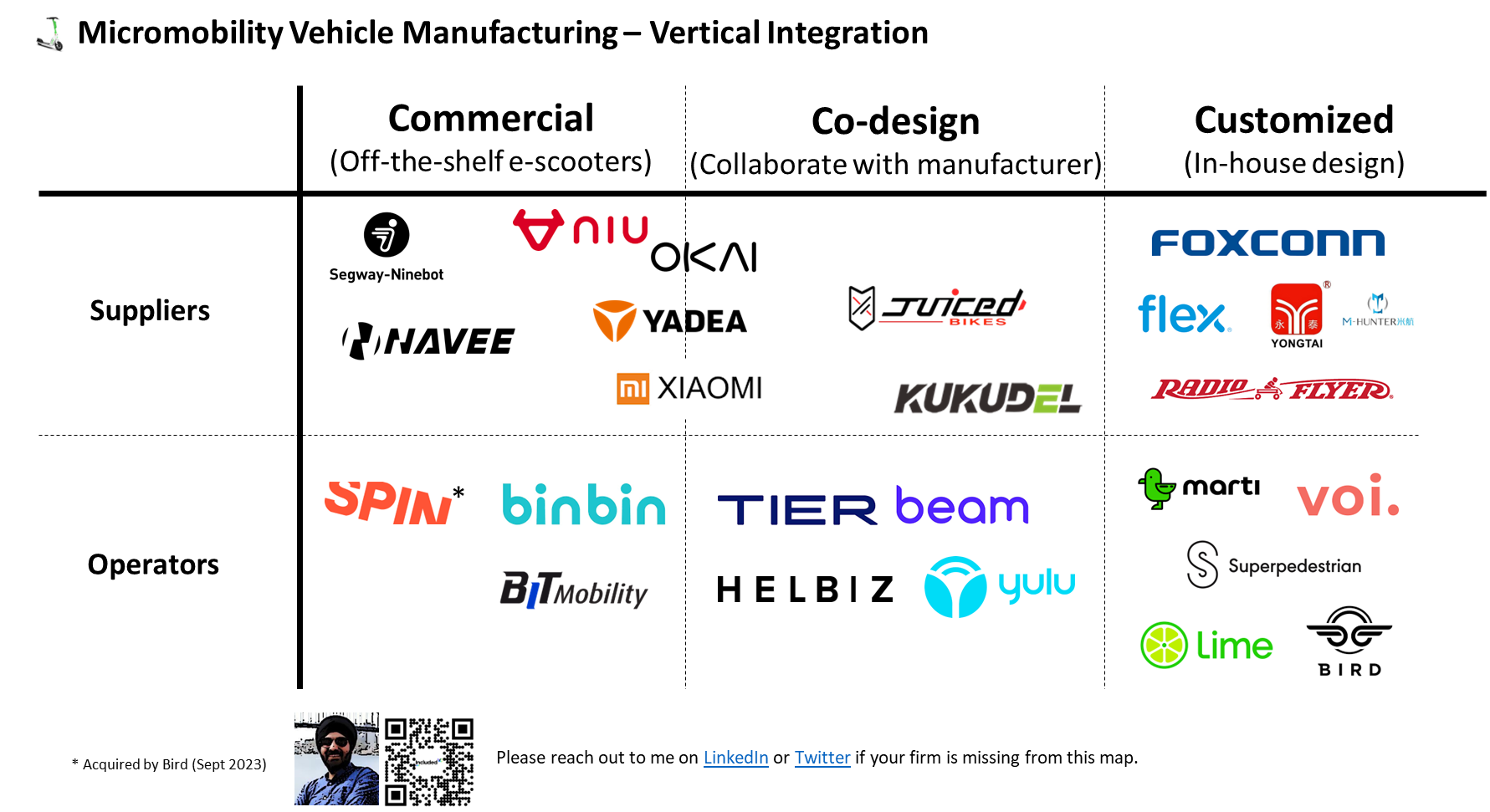

📲 Vertical Integration

The vehicle lifespan is the most critical factor for the unit economics of shared micromobility. The lifespan of the first generation of e-scooters was less than one month. However, the industry has come a long way as the lifespan of vehicles and their performance is improving. There are many intrinsic factors (usage, local condition, permit) and operational factors (battery, maintenance, and technology upgradation).

Most of the vehicles are manufactured by big players in China and control the market dynamics. Most of the large operators have their in-house research and development unit and work with outsourced partners for the manufacturing of the vehicles. The key challenge is the relationship between part suppliers, manufacturers/ assemblers, and operators. The industry is not fully standardized owing to a lack of vehicle regulation. The key suppliers in micromobility usually work with other competing operators or manufacturers, meaning that manufacturers can’t get exclusivity over the supply and can not enforce IP rights. This leads to having very little ownership over their product and becoming over-reliant on a single supplier.

Each company follows different strategies but the companies which are better vertically integrated will be more successful. The vertical integration strategy enables operators to design and build a majority of sub-components and handle final assembly, testing, and packing in-house or through exclusive partnerships.

Bird has reported in its 2023 annual report that it will shift from an in-house model to outsourced manufacturing. The company will develop vehicle elements in-house, such as sidewalk detection, and will work with third-party manufacturers on custom vehicles that focus only on a shortlist of hardware elements.

Superpedestrian has developed a fully integrated vehicle operating system. The company works with Tier 2 to develop the sub-components and testing equipment. After testing all the components in-house, the company works with Tier 1 suppliers for final assembly, testing, and packing.

Beam has an in-house R&D team and co-developed vehicles with Ninebot. All the vehicles are manufactured by Ninebot for their exclusive use.

Lime electric scooters are primarily manufactured by various Chinese companies, including Okai and Ninebot-Segway.

Vehicle integration not only helps the operators to better control hardware but also control firmware and embedded software. This enables the operators to understand riders’ behaviors and vehicle performance under different circumstances.

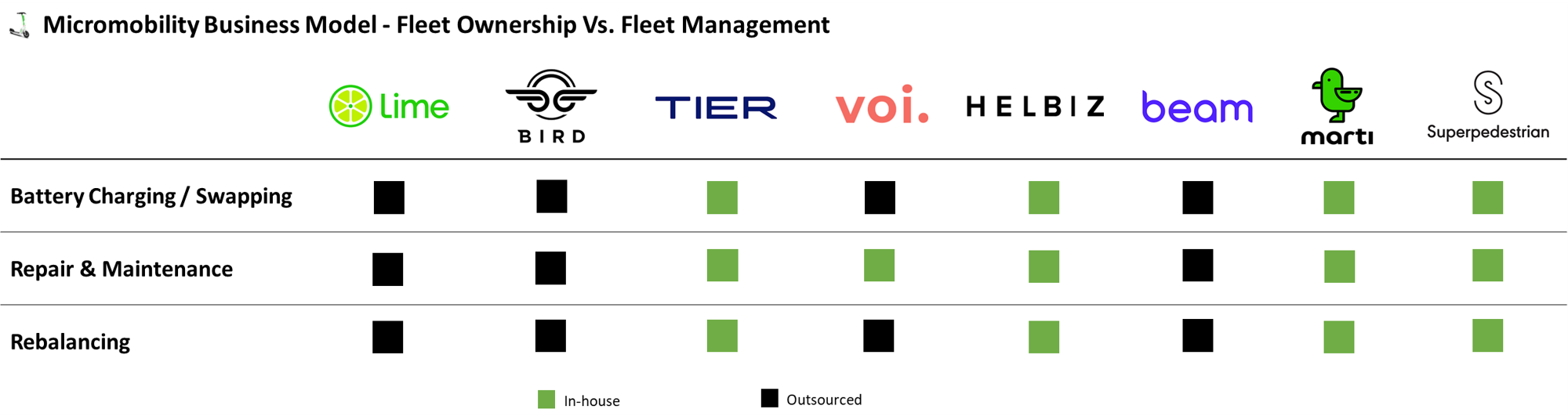

🛴 Fleet Ownership vs. Fleet Management

The new model of micro operators is emerging as some of the operators are outsourcing some of their key functions like charging, repair & maintenance, and rebalancing of the vehicles. There is debate on in-house or outsourced operations. Both strategies have their pros and cons. Companies are following different strategies around the world.

Some of the examples are:

Lime has launched “Lime Juicer” model to work with individuals who collect, charge, and rebalance fleets and pay $5 to $12 per scooter.

Bird has introduced a similar model of hiring a “Charger” for picking up, charging, and dropping off scooters and pays $5-$20 for scooters.

Beam introduced “Marshal” (to charge and rebalance the fleet) and “Ranger” (to hire a mechanic for repair to manage the fleet.

Some of the startups are also working with independent operators to help them start their own fleets. In these cases, the companies provide vehicles, booking apps, and fleet management software. Bird launched its while label application platform in 2018. There are some players including Joyride and Atom Mobility which are powering the fleet around the world.

Moovr is an app-enabled bike and e-scooter-sharing service in the Philippines. The company is using Joyride platform for booking apps and fleet management systems and got scooters from Segway. Moovr is also now testing Okai vehicles. The company has achieved a gross margin of more than 60 percent and running in profit in two cities.

💽 Data Monetization

Micromobility players are collecting large amounts of data from the user. Data is very important for the success of any company as it can help to improve vehicle performance and utilization. Some of the data collected by the operators include:

- Usage (daily/quarterly/annually)

- Total miles (daily/quarterly/annually)

- Summary of distribution and GPS-based natural movement

- Time saved by residents and commuters

- Greenhouse gas emissions reduced

The companies are sharing these data with the cities to better urban planning and infrastructure. Atlanta City (USA) used the data provided by building 12 miles of new light transport lanes in 2021. The operators either voluntarily share data with cities or are required to report as part of the permit condition. However, the companies are not able to monetize these data. Data monetization can help operators to improve their profitability.

Conclusion

Micromobility is here to stay and the adoption of e-scooters will continue to grow around the world. The industry is passing through the “Through of Disillusionment” stage and will be entering the “Slope of Enlightenment”. If you are an investor or founder, who is looking to take the plunge into this space, you should ask these questions:

- The founder should know the market well and identify the competitive advantages. Is the market already crowded if not saturated in big cities?

- What is your product-mix strategy? It is important to have a product mix — e-scooters, e-bikes, mopeds, etc.

- What is your customer acquisition strategy? CAC to LTV is the real question for B2C players.

- It is proven that the B2C market is not defensible as an open market will attract more players. It is important to exclusive permit or license to win the market. Will the city offer exclusive rights?

- What is your vertical integration strategy — both short and long-term? How can you achieve product differentiation? It is becoming increasingly difficult to work with established manufacturers.

- How will you achieve unit economics and increase the average Rides per Deployed Vehicle per Day? These are the most important KPIs. You may have high downloads but utilization is the king?

- Does the city have good infrastructure layers — public transport network or road infrastructure or dedicated lanes? This can help the adoption of mi

- What is your operation strategy — in-house vs. outsourced? It is important to figure out the unit economics for both strategies.

- What is your exit strategy and why it will work?

These questions will help to address the business viability, as well as, market potential. Micromobility sector will continue to grow and adapt to new changing requirements.

—–

About The Author

The article originally published in Included VC Publication. Jaspal Singh is the Founder of Mobility Innovation Lab (MIL) and Host of the Mobility Innovators Podcast. He is also Included VC‘23 Fellow. He loves to talk about startups, mobility, and technology.